The Season of Giving is here, and we at The Dallas Foundation are here to assist you and your clients with year-end giving charitable giving plans. Whether it’s adding to or establishing a donor advised fund, The Dallas Foundation can accept many non-cash assets – real estate, mineral rights, shares of partnerships, and art work—as charitable gifts. If your clients are considering year-end tax strategies that involve complex gifts, such as business interests or restricted securities, we can assist with translating those into philanthropic capital.

The Season of Giving is here, and we at The Dallas Foundation are here to assist you and your clients with year-end giving charitable giving plans. Whether it’s adding to or establishing a donor advised fund, The Dallas Foundation can accept many non-cash assets – real estate, mineral rights, shares of partnerships, and art work—as charitable gifts. If your clients are considering year-end tax strategies that involve complex gifts, such as business interests or restricted securities, we can assist with translating those into philanthropic capital.

This publication contains some helpful information along with key deadlines for charitable gifts than can begin to make an immediate impact on our community.

For complete details on donation instructions, including wire, ACH and stock transfers, click here. For any additional questions about year-end donations, please contact Julie Diaz, vice president of philanthropic partnerships.

Have a wonderful holiday season,

Gary W. Garcia

214-741-9898

gwgarcia@dallasfoundation.org

Table of Contents

- Philanthropic Giving Strategies for Your Clients

- Important Year-end Dates

- When Life Insurance is no Longer Wanted or Needed

- Due Diligence and Strategic Community Impact

- The Perfect Holiday Gift Option: Giving for Good Cards

Philanthropic Giving Strategies for Your Clients

While obtaining a tax benefit is never the real purpose of charitable giving for your clients, when possible it is still wise to give in a way that reduces their lifetime or estate taxes. Whether they personally benefit from the tax savings or choose to pass it on to their favorite charities through additional donations, these tax-planning techniques are worth consideration.

Read the full article about philanthropic giving strategies.

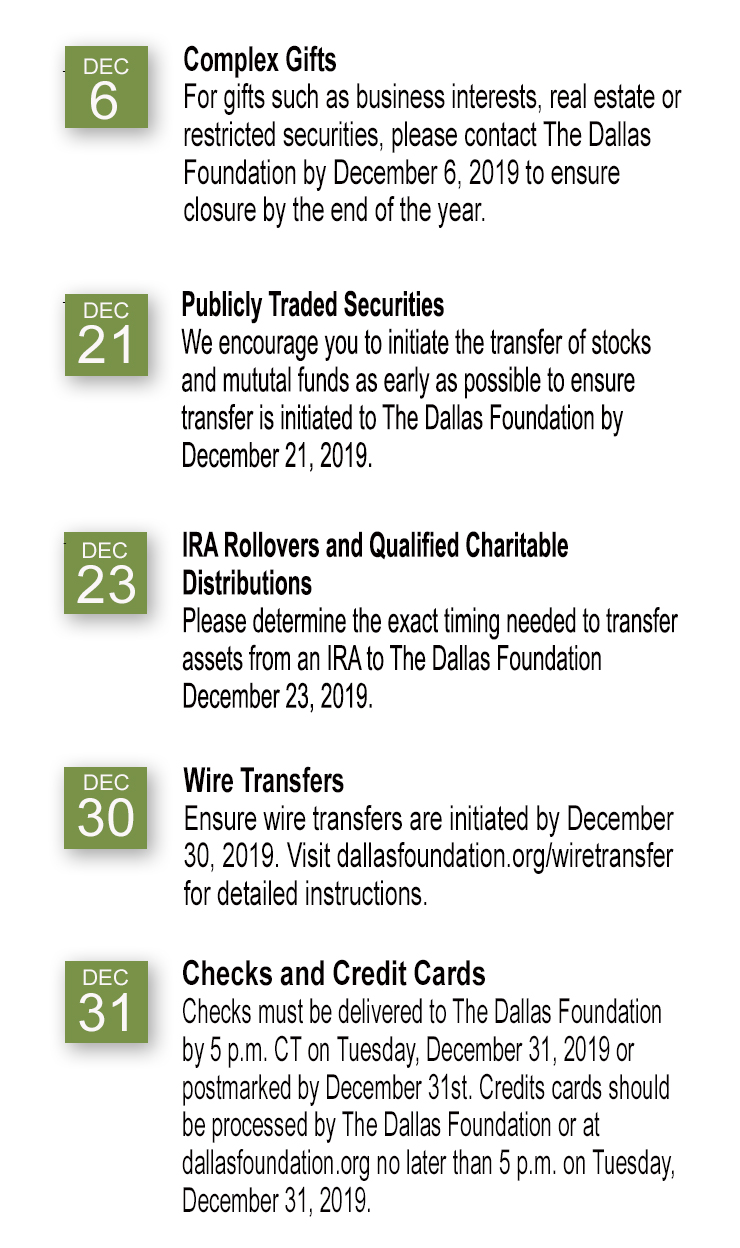

Important Year-end Giving Dates

When Life Insurance is No Longer Wanted or Needed

By Todd S. Healy, Texas Financial Partners

A study recently determined that over $112 billion of life insurance, on people over 65, lapses every year. The policies are being surrendered due to: a perceived decrease in their estate tax liabilities; policies with increasing costs that are in danger of terminating; or changes in the reason for purchasing the life insurance. Whether the policies are owned by your clients, or by the charities you work with, there may be a better solution than merely “cashing in” the policies.

Due Diligence and Strategic Community Impact

While there are many worthy causes, only donations to qualified 501(c)(3) organizations are tax-deductible. When gifting through The Dallas Foundation, we document the status of all nonprofits prior to making a gift on your client’s behalf and can help you identify organizations that are qualified to receive gifts. The Foundation can also help you and your clients create a giving plan to ensure strategic community investments, making the greatest impact on the causes they care about while maximizing tax advantages.

The Perfect Holiday Gift Option: Giving for Good Cards

Giving for Good cards provide the perfect holiday gift option. Whether you want to inspire charitable giving in your children or grandchildren, your clients or recognize employees for a wonderful year, The Dallas Foundation’s Giving for Good card is a gift that gives back.

Giving for Good cards provide the perfect holiday gift option. Whether you want to inspire charitable giving in your children or grandchildren, your clients or recognize employees for a wonderful year, The Dallas Foundation’s Giving for Good card is a gift that gives back.

Choose from several holiday-themed designs, or businesses can create a customized card. Recipients of a Giving for Good card may redeem cards on dallasfoundation.org or they may give the cards directly to any 501(c)(3) nonprofit organization (by mail or in person), including houses of worship.

Celebrate the holidays with Giving for Good cards and inspire others to give back.